The Canonic Portfolio has now gone to a targeted 52.5% loss for the year. Namely if the market continues to respond to the perceived economic conditions the stock market of "reasonable" dividend yielding stocks will drop to 52.5% of what they were on January 1, 2009.

There is money in the system, on the sidelines, and elsewhere, but it is not entering the market. If this continues we may be looking at a very bleak year.

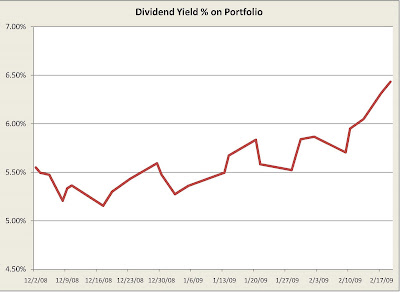

There is a second curve which is even more interesting. This is the Dividend yield of the portfolio if it were bought at the date of the axis value, for example as of today the portfolio would yield a dividend of 6.43% up from the initial yield of 5.5%. This is a 20% increase in dividend yield. The increase in effective dividend yield is also a measure of forward looking inflation. Thus this metric shows we are looking at potentially a 20% inflation. We will be measuring this rate as well. The Market seems to be factoring in a tremendous inflation rate in anticipation of forward looking changes. This may be the Canary in the Mineshaft!