I suspect that Congress has not done a bit of analysis on the impact of the inclusion of those under 65 into Medicare. Sounds goo, one would think, yet perhaps a simple back of the envelope analysis will help. Yes, numbers do mean something.

Let us go back to what we analyzed a few months ago, namely the current Medicare plan.

1. If one started work in 1970 and in 2005 retired at 65, then during that period you contributed to the Medicare plan at the rate of 3% of your gross salary per year.

2. If the contributions had been wisely set aside in a very conservative bank account, yet they were not, Congress stole them, you would have had in the fund $165,000 ate that time.

3. You would have a 12 year life expectancy and thus at the current Medicare costs of $12,000 per person per year, if that money were to be placed in an annuity it would have generated $19,000 per year and you would have overpaid for any benefits you would have received.

This analysis is for an average employee, not for a minimum wage person or any professional. But on average it applies.

Now let us go to the absurd idea of having the 55-65 "buy in" to Medicare. The New Testament tale of the first shall be last and the last shall be first and that each worker gets paid the same no matter how long they work in the fields does not apply here, I would argue. This is not religion and it is simple economics.

Now for the analysis.

1. Assume we open the program up for those 55-65.

2. Assume we allow for a "buy in" which is neutral and equal to those who are 65 and over. Namely the new buy in crow pays an amount per year so that they have equity with those who paid in all their life.

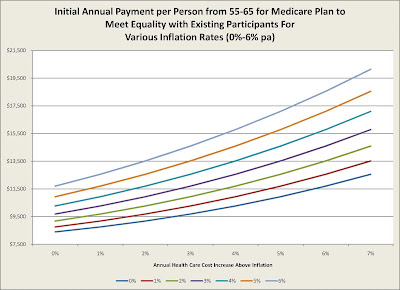

The result is below:

Using the simple method of matching net present values of cash flows, and factoring in health cost inflation and inflation itself, the above depicts the cost per year from 55 to 65 to buy in at an equity basis depending on the variables. Namely if there is no cost increase in health care above inflation and in fact there is no inflation then the cost is $8000 per year per person, what we see as the existing costs. No surprise there. However if we see a 3% health care cost rise above inflation and a 3% inflation then the price t buy in become $12,000! Otherwise the system disadvantages those who already paid in!

This is another slight of hand by Congress. This is another slap in the face to those on Medicare.

Now to the Gresham's Law issue, bad money driving out good. Here what will happen.

1. If this is done, then those on the new buy in system will result in a doubling of the number on Medicare.

2. Medicare will drive down reimbursements to providers to control costs.

3. Congress will "charge" a low buy in costs thus making it attractive but no where cost neutral.

4. Excess losses to Medicare will result in further provider cost reductions.

5. Quality Providers will leave the Medicare system as they have left Medicaid.

6. The existing 65 and overs who have contributed beyond their current reimbursements will get pushed out of the quality care they have paid for.

7. The 55-65 will get a "free ride" for a short period then they too will have reduced care.

8. The bad money Medicare System will push out the good money Medicare System and at the same time the new "bad" system will become the single payer public option and all the progressives will be happy and those in the system will be suffering the pain.

As they say, one cannot make this up. And where is the Press on this one, out to lunch. The reason, it requires a simple 30 line spread sheet and an ounce of understanding, the Press has none, never did, never will. Thank God it is soon to disappear!

Let us go back to what we analyzed a few months ago, namely the current Medicare plan.

1. If one started work in 1970 and in 2005 retired at 65, then during that period you contributed to the Medicare plan at the rate of 3% of your gross salary per year.

2. If the contributions had been wisely set aside in a very conservative bank account, yet they were not, Congress stole them, you would have had in the fund $165,000 ate that time.

3. You would have a 12 year life expectancy and thus at the current Medicare costs of $12,000 per person per year, if that money were to be placed in an annuity it would have generated $19,000 per year and you would have overpaid for any benefits you would have received.

This analysis is for an average employee, not for a minimum wage person or any professional. But on average it applies.

Now let us go to the absurd idea of having the 55-65 "buy in" to Medicare. The New Testament tale of the first shall be last and the last shall be first and that each worker gets paid the same no matter how long they work in the fields does not apply here, I would argue. This is not religion and it is simple economics.

Now for the analysis.

1. Assume we open the program up for those 55-65.

2. Assume we allow for a "buy in" which is neutral and equal to those who are 65 and over. Namely the new buy in crow pays an amount per year so that they have equity with those who paid in all their life.

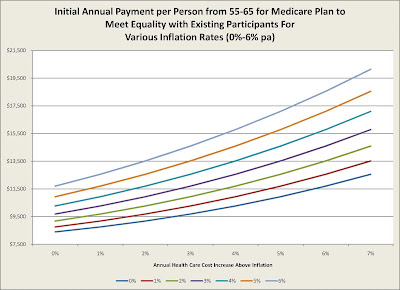

The result is below:

Using the simple method of matching net present values of cash flows, and factoring in health cost inflation and inflation itself, the above depicts the cost per year from 55 to 65 to buy in at an equity basis depending on the variables. Namely if there is no cost increase in health care above inflation and in fact there is no inflation then the cost is $8000 per year per person, what we see as the existing costs. No surprise there. However if we see a 3% health care cost rise above inflation and a 3% inflation then the price t buy in become $12,000! Otherwise the system disadvantages those who already paid in!

This is another slight of hand by Congress. This is another slap in the face to those on Medicare.

Now to the Gresham's Law issue, bad money driving out good. Here what will happen.

1. If this is done, then those on the new buy in system will result in a doubling of the number on Medicare.

2. Medicare will drive down reimbursements to providers to control costs.

3. Congress will "charge" a low buy in costs thus making it attractive but no where cost neutral.

4. Excess losses to Medicare will result in further provider cost reductions.

5. Quality Providers will leave the Medicare system as they have left Medicaid.

6. The existing 65 and overs who have contributed beyond their current reimbursements will get pushed out of the quality care they have paid for.

7. The 55-65 will get a "free ride" for a short period then they too will have reduced care.

8. The bad money Medicare System will push out the good money Medicare System and at the same time the new "bad" system will become the single payer public option and all the progressives will be happy and those in the system will be suffering the pain.

As they say, one cannot make this up. And where is the Press on this one, out to lunch. The reason, it requires a simple 30 line spread sheet and an ounce of understanding, the Press has none, never did, never will. Thank God it is soon to disappear!