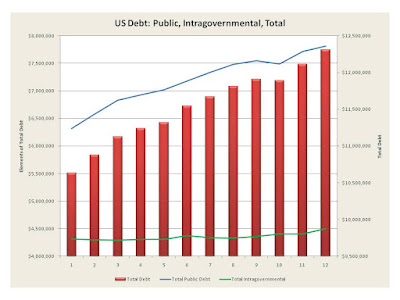

We have been looking at the debt and its components for the past year and some interesting trends are appearing. The above is the debt and its public and intragovernmental elements. Readers should remember that the intragovernmental elements are what Congress steals from our Social Security and Medicare to pay for the redistribution programs and pork to keep them in DC. The public debt is what China and our other friends have been talked into buying.

Now let us look at the public side as below.

The above shows the purchase of the public debt is moving to the longer held instruments since the shorter instruments are paying little is any interest. We had shown this a few days ago when we commented on the yield curve.

This is good and bad. It is good in that one may say that the buyers see little long term inflation. It is bad in that if there is long term inflation they will sell these on the market even at a massive loss and this will result in a spiral downward in a positive feedback mechanism just in the middle of an inflationary time and will exacerbate it.

How can this happen? Well simply, the FED can really start printing money. Why would this happen, because the buyers just do not "feel" any trust in US policy.

My concern is that the yield curve is driving us to a possible tipping point with inflation arising not from just printing but loss of faith in the country.