The fundamental problem that much of the world faces today is that investors are overreacting to debt-to-GDP ratios, fearful of some magic threshold, and demanding fiscal-austerity programs too soon. They are asking governments to cut expenditure while their economies are still vulnerable. Households are running scared, so they cut expenditures as well, and businesses are being dissuaded from borrowing to finance capital expenditures. The lesson is simple: We should worry less about debt ratios and thresholds, and more about our inability to see these indicators for the artificial – and often irrelevant – constructs that they are.

The reality is that as we start to see inflation hit we will see interest rise greatly. Most of the Treasury lending is short term and it will adjust rapidly. That will drive up interest payments.

Now look at the total debt by interest rate in Bills, Bonds and Notes. First Bills:

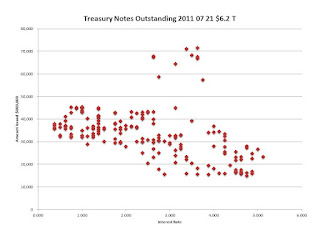

Now for Notes:

We have a great deal at the low end but there is still a substantial tail. Now if inflation occurs we will see that explode. We have about $1 trillion in this long term and about $6 + trillion in short term. That really is the problem.

The Bonds then are:

Note here that we have the clumping at the low end but it does go well above 4 and above 5%! That would mean a 10X increase in interest. Shiller seems to ignore that fact. The RM effect can and will cause havoc on the economy unless we halt deficit and reduce the debt!

Of course the left wing economists who pushed this scheme that got us where we are think in line with Shiller. As they state:

High unemployment also lowers long-run economic growth, but we aren't we putting nearly as much effort into that problem as we are into austerity. Where are the White House meetings with key Republican leaders over what to do about the unemployment problem? True, Republicans might not show up show up for such a meeting, but so what? Pictures of empty chairs at a meeting focused on helping the unemployed would send a strong message about what really counts for the GOP. Unfortunatley, Democrats seem to have forgotten about the unemployed as well -- right now all the chairs are empty -- and that sends a strong message as well.

But as one who has created jobs a few times in my lifetime I can assure the academics who have never bet the ranch on a business that (1) Washington never created a real job, just look at NASA and the Space Shuttle, lots of money to launch science projects, (2) real jobs are created by risk takers who see a reward, and with the current Administration they want to tax both income and wealth. Why do anything until the dust settles.