The FED Balance Sheet is shown above as of yesterday. Note that not much has changed.

Note the difference. Here we have removed the Mortgage Securities. Mostly Treasuries. Soon they must begin to unload this junk and at a much higher interest rate.

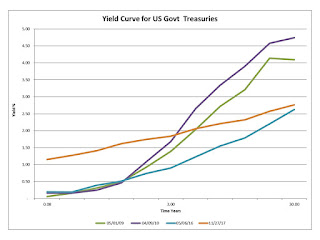

Based on this, the yield curve, the Trump Tax Plan, we expect significant inflation over the next three years. That will be one way to reduce the debt. I believe they did that in Germany in the 1920!

Wednesday, November 29, 2017

Tuesday, November 28, 2017

Freedom of Speech?

Just saw this on China Daily. Worth thinking about.

The open trial of Peng and Lee will also help the public to know that the two defendants attempted to subvert State political power by forming online chat groups, and used them in a planned way to spread the idea of political subversion. Their activities violated China's Constitution and laws. And no country, let alone China, will tolerate such activities. The case once again shows the judiciary's determination and ability to safeguard State security and maintain social stability in accordance with the law.

No other comments!

The open trial of Peng and Lee will also help the public to know that the two defendants attempted to subvert State political power by forming online chat groups, and used them in a planned way to spread the idea of political subversion. Their activities violated China's Constitution and laws. And no country, let alone China, will tolerate such activities. The case once again shows the judiciary's determination and ability to safeguard State security and maintain social stability in accordance with the law.

No other comments!

Labels:

China

Yikes! Look at the Yield Curve!

Look at this yield curve. The short term is exploding and long term collapsing. That means in the long term there is no anticipation of growth but that short term there is great uncertainty!

The above clearly makes this point. Look at the spread, going to zero!

The above clearly makes this point. Look at the spread, going to zero!

Labels:

Economy

Sunday, November 26, 2017

More on Trump Tax

Dear Congressman Frelinghuysen,

I wish to bring to your attention two related issues. The

first is the imposition of imputed income on Graduate students in the US. The

second is Government funding of foreign students by various Government

agencies. Both issues present clear and present dangers to the security of the

United States. I base these conclusions on personal knowledge at academic

institutions as well as my extensive international business experience in over

twenty countries.

Permit me to lay out the details related thereto:

1 My background is a combination of academic and business actions. I hold a PhD from MIT in Electrical Engineering. I have been on the faculties of almost a half a dozen institutions including MIT, Columbia, GWU, and the Beijing University of Economics and Finance. I have personally started and operated companies in over twenty countries with offices in Moscow, Prague, Warsaw, and Athens. Most recently I returned to MIT from 2005 through 2012 to assist a half dozen Doctoral students. I also work with colleagues at Columbia Cancer Center in New York.

I have had extensive experience in major universities and

also as an entrepreneur having started and/or financed some thirty-five

companies. As such I have a somewhat unique set of experiences and expertise

regarding the issue which I put before you in this correspondence. I also have

been a resident of your District for nearly forty years.

2 The New House Tax Code materially changes the ability of Graduate students to finance their education

The new Tax proposal by the House makes some major

material changes to various elements of the tax code. This correspondence

refers mainly to that regarding the imposition of an imputed income on Graduate

students resulting from being a teaching or research assistant. My argument

herein demonstrates that this change can and in my opinion will cause

irreparable harm to the United States. Simply it will drive the remaining US

citizen grad students out of Grad school, except for that small amount from

families independently wealthy and capable of sending a student to such

institution. However my experience is that most if not almost all students in

Grad school for science and technology come from families of lesser means. In

my own case I worked my way through MIT as an Instructor, and could not have

done so under the proposed tax laws. In fact not being able to have done so

would have resulted in thousands of lost jobs in our economy from the many

companies I was able to start and/or finance.

3 Currently almost 80% of Graduate students in Science and Engineering are foreign.

The NY Times has a piece on the increasing percent of

engineering graduate students who are foreign. They state:

At the

undergraduate level, 80 percent are United States residents. At the graduate

level, the number is reversed: About 80 percent hail from India, China, Korea,

Turkey and other foreign countries.

This is a startling figure but one should ask; who is

paying? Having spent an almost sixty years career in and out of Academia, I can

make the following observations related thereto.

1. In the late 1950s the US Government made a major push

to create more engineers and scientists. There were scholarships and

institutions were incentivized to follow through. There were many scholarships

and fellowships specifically for these types of degrees. Furthermore tuition

was low, due mainly to the fact that overhead at Universities was minimal.

Graduate fellowships were numerous, and were all performance related. If one

did well in the right undergraduate curriculum then Grad school was effectively

free. These graduates then went to the work force and created the technologies

that underpin our national defense and competitive technologies. This is no

longer the case.

2. Most of the grad students were first generation,

coming from families that in many cases did not even graduate from a college. Frequently

engineering and science was an entry point for the lower economic classes.

Families with money often sent their children to exclusive schools and then in

to banking or law.

3. Upon graduation jobs were available, especially for

Graduate students with good degrees. Engineers and scientists entered areas

such as solid state design, RF engineering, and the like. People during this

period built things as compared to today's social media types who

"code" screens which engage the users but one can argue has little

value.

4. At that time places like Silicon Valley were

inexpensive, allowing for a diverse group of workers. Housing was plentiful; and

at reasonable prices. Startups made "real stuff", not just software

enhancements.

In contrast, in today's world:

1. Almost all high tech grad students are funded by the U.S.

Government. Yet 80% are foreign students who are also funded by the taxpayers.

Those Chinese, Iranian, Syrian, grad students are funded by US tax dollars.

They finish on our tax dollars and return home. In the case of the Chinese

students they often bring this expertise back to Chinese companies and then these

companies directly compete with the US. That is true in both for commercial and

military entities.

2. US undergrads are often financially burdened when they

finish their undergrad and thus are pressured to work and pay back the loans as

well as taxes. As a side note the new Trump Tax Plan makes the student loan no

longer deductible, another burden. The taxes taken from American students, and

others, will then go to support the 80% of the grad students who are foreign.

3. What can be done? I believe it is simple; look back to

the 1950s. Eisenhower may very well turn out to be our greatest President. His

Administration saw the threat and at the same time the opportunity. The found

ways to fund high performing undergrad tech students. Then make it a level

playing field for US citizen students, especially if the taxpayer is footing

the bill, the taxpayer should have preference. One should put a finger on the

scale for US students.

4 Many, a great majority of truth be told, of the foreign Graduate students have their education funded by the US Government via Research Grants to Faculty members.

In my experience at MIT and other institutions, to this

current day, Grad students are funded by research grants almost exclusively

from US Government entities. Of the six doctoral students I assisted from 2005

through 2012 not one was an American citizen. Only one remained in the US after

marrying an American citizen. All others returned to their country of origin.

They took with them expertise vital to the success of the US. In addition

without exception they were funded by DoD or DoD related research!

5 Moreover many of the foreign Graduate students in high tech such as Electrical Engineering and Computer Science are funded by DoD or similar national security sources.

The problem is not just that the foreign students are here

and funded by US entities but that many of these in critical areas are funded

by US DoD or related entities.

6 Graduating Foreign Students all too frequently return to their homes unable to remain productive in the U.S.

I had tried on multiple and repeated times to try and

keep the students here. They wanted to stay. Yet Immigration Laws prevent this

from happening. This results in the loss of intellectual capital paid for by

the taxpayer and the transfer of this capital to risky if not outright hostile

countries.

7 Many of the high tech foreign Graduate students returning to their countries after having been financed by DoD or related Government sources find their way into the home military or intelligence agencies. As a result many foreign Graduate students are being educated by US Taxpayers via DoD or related Government sources and return to pose potential long term threats to the security of the United States.

I have seen many of these students returning to their

home countries and finding positions in the defense or related industries. They

have no choice since the U.S. will not accept them as potential citizens. This

means that we really must re-examine our immigration laws regarding high tech

and bio related graduate students. We must try to retain them, give then

flexibility, no tie them to some work visa structure which benefits an employer

but not eh U.S. If we are to invest them we then want the ability to gain the

return on that investment.

8 The current Tax Code as noted below allows for US students to NOT include imputed tuition costs if they are Teaching or Research Assistants (TA or RA).

Namely Section

117 (c) allows for the exclusion of imputed tuition costs. That is highly

acceptable. See Appendix A.

9 The new House proposal eliminates the student’s ability NOT to include the imputed costs. In fact it makes the student include them which often dramatically increases the burden on US students making it impossible to attend Graduate School

Now

quoting from the House Bill, on p 96 we have

SEC.

1204. REPEAL OF OTHER PROVISIONS RELATING TO EDUCATION. (a) IN GENERAL.—Subchapter B of chapter 1 is amended—

(1) in part VII by striking sections 221

and tons in the table of sections for such part), (2) in part VII by striking

sections 135 and 127 (and by striking the items relating to such sections in

the table of sections for such part), and (3) by striking subsection (d) of section 117.

And on p

98 of the House Bill we see:

(e) CONFORMING AMENDMENTS RELATING TO SEC11 TION

117(d).— (1) Section 117(c) (1) is

amended— (A) by striking ‘‘subsections (a) and (d)’’ and inserting ‘‘subsection

(a)’’, and (B) by striking ‘‘or qualified tuition reduction’’.

Namely

the law is changed to allow for a imputed income resulting from an

assistantship.

10 The combined results of funding foreign students and now taxing US students for unearned imputed income creates a clear strategic threat to the United States. In fact this is a clear and present danger. It strengthens our adversaries while debilitating the U.S to combat these adversaries.

The

proposed taxing of Grad School tuition for Research Students would drive the

20% of American Grad students to 0% it is the "Make America Last"

Act. We would be left with 100% Chinese, Iranian, Indian, Vietnamese etc

students who will get all of our ideas paid by Government dollars and take it

home to demolish our economy. Frankly this is one of the dumbest ideas I have

ever seen. I managed to succeed due to Eisenhower and his innovations. Remember

Admiral Yamamoto went to Harvard, he then bombed Pearl Harbor. We do not want

to repeat that! The proposed new Tax Plan as many destructive elements. It

helps the rich but destroys our future. For example, the journal Nature states:

Graduate students, who receive

the lion’s share of tuition waivers, would be most affected. And 60% of the

145,000 students who get tuition reductions each year are working in science,

engineering, technology and mathematics fields, the US Department of Education

estimates. The amount of money that the government would reap from these taxes

would be minuscule, given the $20.5-trillion national debt. But it could weigh

heavily on young scientists. Take a hypothetical PhD student at the

Massachusetts Institute of Technology (MIT) in Cambridge, in receipt of a $23,844

NIH stipend. Under the current system, she would pay very little in taxes. The

new law would add her $49,000 MIT tuition bill to her taxable income as though

she were paid a $73,000 salary — an amount she never actually sees. This would

add thousands of dollars to her tax burden.

Thus, a

student would get about $24,000 plus an imputed say $50,000. Under the old plan

they paid tax on $24,000. On the new plan it tax on $74,000. Namely with a

$12,000 deduction it would be 15% of $62,000 or $9300. That is a 39% tax rate!

Plus 3.5% for FICA plus 3% for Medicare plus in Massachusetts an added 8%. This

is a 53.5% Tax Rate!

Now we

already have 80% of the Grad students funded by their Governments, China and

Iran. The remaining 20% are US and are paying the burden. So what will happen?

Drug development, high tech development etc will all migrate to these

countries. Not to mention weapons development. Eisenhower saw the need for a

strong technology core. In contrast, Team Trump wants to destroy whatever

future we may have had.

11 Some argue that the new House Bill has no true effect. They are grossly in error.

The

recent House Tax Bill eliminates the ability of Grad students to not pay tax on

a Teaching or Research Assistant-ship. Namely it means that they must pay tax

on $50,000 or more of money never received. Well they will destroy America as

we know it. Perhaps that was the intent of the Republicans, I leave that to

them. But Forbes has a writer who declares:

On the chopping block in House

Republicans’ bill is section 117(d) of the Internal Revenue Code, which exempts

qualified tuition waivers from taxation. Many graduate students work as

teaching or research assistance while completing their studies; universities

often waive their tuition and provide a small living stipend as compensation.

The House plan would treat these tuition waivers as taxable income, which

graduate students fear could lead to annual tax hikes of several thousand

dollars. Anxiety among graduate students and those considering graduate education

is understandable. But what the narrative around this provision has missed is

that the House bill does not touch another provision of the tax code: section

117(a). This section provides that scholarships used to pay tuition and fees

are not considered taxable income. The catch is that universities which provide

these scholarships cannot stipulate that students work as teaching or research

assistants as a condition of receiving them. This is the main difference

between scholarships and qualified tuition waivers: universities can require

students to work as a condition of receiving the latter, but not the former.

Under current law, both scholarships and tuition waivers are not taxable. But

the House bill draws a distinction between the two. Under the proposal,

universities can still reduce their students’ tuition bills without incurring

tax consequences. However, if graduate students work as teaching or research

assistants as a condition of getting that tuition help, then the amount of

tuition reduction would be considered taxable income. Universities that wish to

avoid saddling their graduate students with large tax bills therefore have an

easy way out. They can reclassify their qualified tuition waivers as

scholarships...

This is

grossly false. The RA cost is charged to the research grant, usually a

Government contract, and thus is netted to zero for the University. As a

Scholarship it is not netted against the grant and thus comes out of the

endowments or other similar funds. Perhaps for a TA this would work but there

are fewer TAs and more RAs.

The

main question is; who put this element in the Tax Bill and why? Now in my

experience, Congress never really writes anything, Lobbyists do. So follow the

money. Who did this?

12 To remedy this the US should promptly take the actions of: (i) removing the tax burden of section 117 as proposed by the House, and (ii) prohibiting the funding of students from hostile or potentially hostile countries by US agencies which research could be considered a threat to the US security or economy. Overall, Government should be looking out for the best interests of Americans. That means we need an understanding of the Eisenhower days, just after Sputnik. We managed to support the research areas and education of those most critical to our economy and security. The payoff lasted for decades. Now however is waning and just the opposite is occurring. Namely we are driving US students out with maniacal tax stipulations while funding the education and strategic capabilities of our adversaries, military and industrial.

I

strongly recommend that the above recommendations be considered. I greatly

appreciate your opposition to the Bill but after consideration this section can

and I assure you shall cause irreparable harm to the United States! Its

inclusion reflects a gross ignorance of what has allowed the US to be

successful after WW II. This must be corrected promptly.

Very

truly yours,

Appendix

A

26 U.S. Code § 117 - Qualified scholarships

Qualified scholarships

Gross income does not include any amount

received as a qualified scholarship by an individual who is a candidate for a

degree at an educational organization described in section 170(b) (1) (A) (ii).

(1) In general: The term “qualified

scholarship” means any amount received by an individual as a scholarship or

fellowship grant to the extent the individual establishes that, in accordance

with the conditions of the grant, such amount was used for qualified tuition

and related expenses.

(2) Qualified tuition and related expenses for

purposes of paragraph (1), the term “qualified tuition and related expenses”

means—

(A) Tuition and fees

required for the enrollment or attendance of a student at an educational

organization described in section 170(b) (1) (A) (ii), and

(B) Fees, books, supplies,

and equipment required for courses of instruction at such an educational

organization.

(1) In general Except as provided in

paragraph (2), subsections (a) and (d) shall not apply to that portion of any

amount received which represents payment for teaching, research, or other

services by the student required as a condition for receiving the qualified scholarship

or qualified tuition reduction.

(A) The National Health

Service Corps Scholarship Program under section 338A (g) (1) (A) of the Public

Health Service Act,

(B) the Armed Forces Health

Professions Scholarship and Financial Assistance program under subchapter I of chapter

105 of title 10, United States Code, or

(C) A comprehensive student

work-learning-service program (as defined in section 448(e) of the Higher

Education Act of 1965) operated by a work college (as defined in such section).

(2) Qualified tuition reduction For

purposes of this subsection, the term “qualified tuition reduction” means the

amount of any reduction in tuition provided to an employee of an organization

described in section 170(b)(1)(A)(ii) for the education (below the graduate

level) at such organization (or another organization described in section

170(b)(1)(A)(ii)) of—

(B) Any person treated as an

employee (or whose use is treated as an employee use) under the rules of

section 132(h).

Paragraph (1) shall apply with respect to

any qualified tuition reduction provided with respect to any highly compensated

employee only if such reduction is available on substantially the same terms to

each member of a group of employees which is defined under a reasonable

classification set up by the employer which does not discriminate in favor of

highly compensated employees (within the meaning of section 414(q)). For

purposes of this paragraph, the term “highly compensated employee” has the

meaning given such term by section 414(q).

(5) Special rules for teaching and research

assistants In the case of the education of an individual who is a

graduate student at an educational organization described in section

170(b)(1)(A)(ii) and who is engaged in teaching or research activities for such

organization, paragraph (2) shall be applied as if it did not contain the

phrase “(below the graduate level)”.

Labels:

Economy

Eric Ackerman and the Old World of Intelligence: UK Style

The book by Jackson and Hayson, Covert Radar and SignalsInterception, is a well done presentation of the life and accomplishments

of Eric Ackerman, one of the many brave and brilliant people who worked for R.V.

Jones during WW II. Ackerman is a bit unique because of his brilliance in the

ever developing electronic technologies combined with his daring in taking to

the field at the time of war the systems used to penetrate and defat the German

systems. Eric grew up in somewhat humble beginnings and his schooling was in a

technical school. Despite these limitations, he managed to become one of

Jones’s stars and an RAF officer, albeit not an active pilot.

The book covers Eric from his early life through the War and

then into the Cold War. Eric was instrumental in a variety of signal

intelligence and became almost a one man NSA, as the Americans would develop.

Eric had the ability to understand enemy systems and techniques and then

rapidly develop methods and systems to compromise them. Often he performed

these tasks near or behind enemy lines and often at great personal peril.

The book provides full details on many of these exploits. It

also provides a window to some of the personal elements of Eric’s life, his marriage

and his family.

I had the good fortune of working with Eric Ackerman from

1977 through 1980. I was his boss t COMSAT, but in many ways I was learning

from him. I inherited Eric from his staff slot at COMSAT Labs. In 1977 I was at

COMSAT Corporate, for two years since coming down from MIT. My experience was

academic as well as in the military radar and Intel worlds. So unbeknownst to

me Eric and I had somewhat a similar path, although during differing Wars. I

had been approached by Government agencies to build a set of small earth

stations and the related network of satellites and infrastructure for what was

to be the verification systems on the Comprehensive Test Ban Treaty with the

US, UK and USSR. I had done a preliminary system design and the “customer” was

happy and wanted it Implemented.

Thus I needed more folks and as luck would have it, Eric

showed up at my office and said: “I was told to report to you. What do you want

me to do?” Eric was then about 58, my father’s age and I was mid 30s on my way

to 40. Yet one thing I knew was, unlike so many of today’s techies, I saw great

deal of value to those who had come before me. Thus began my three years with

Eric.

We assembled a team and designed the system in detail. Then

we were awarded the contract to build it. That we did in record time, despite

the massive political nature of COMSAT. Nearly everyone wanted a piece of it,

and without the skill of Eric navigating the political and technical waters we

would never have delivered the world’s first VSAT, or very small aperture

satellite system. It went out to our customer and passed all tests with flying

colors. Then things got really interesting. I had no idea who Eric was other

than a good Brit system designer and one who had fantastic people skills. So

when I got a significant promotion, building all of COMSAT’s equipment

deliverables I chose Eric as my Chief Engineer.

Then Eric and I went out to meet our “customer”. We were to

discuss the details of full implementation and deployment. I had been seconded

to U.S. Arms Control and Disarmament Agency as part of the Comprehensive Test

Ban Treaty team so I had become more involved in details, while keeping my ever

expanding corporate duties. I relied on Eric more each day. On this visit to

our “customer” we both had security clearances and I had a bunch more but when

we got to the gate Eric was denied entry. We were told by Security at this

“customer” that a Brit engineer was not allowed on the premises, period.

Besides they asked: “Who is this Ackerman anyway?” I did not know even then of

Eric’s background. We had traveled a long distance from Washington and here I

had to leave Eric in the hallway all day! I felt mortified. After all, we had

apparently done all we should have and here is some Government clerk telling us

off.

After the meeting we took a flight back to Washington via

Chicago. As luck would have it there was a massive blizzard and what would have

been just a few hours of air flight ended up being half a day, waiting, in

holding patterns, waiting etc. This is when I got to really know Eric. In those

days I could bump to First Class on a 727 and smoking was allowed and Scotch

flowed like water. Eric was in heaven. I apologized again for his rather shabby

treatment and, after a few Scotches, Eric started telling me the past, and my

“war stories” paled by comparison to his. I soon learned of R.V. Jones, then of

his flights in and out of rather risky spots, his tricks played on the Germans,

then his time doing the same on the Soviets. The tales in this book are but a

few I became privy to. All in that half empty First Class cabin trying to get

to Chicago. The worse the flight got, the more Eric had of the Scotch and the

more detailed the stories. Eric was truly a hero in his own day.

I found that I had a group in my own Division doing what

was, let us say, unsanctioned side work. Needing to find out what was going on

I asked Eric if he had any ideas. Well, Le Carre step aside! I was invited to

meet Eric and his colleagues at a small bar on Massachusetts Avenue, just a bit

down from the British Embassy. It was a warm autumn day and at abbot 2 PM. I

entered the bar. It was dark and near empty except for a cloud of smoke from

the booth at the rear. I walked back. There was Eric with several of his old

colleagues, all Brits. I now had a fully experienced Intel operation. Needless

to say they did a splendid job solving my problem and keeping the results

somewhere in the British Embassy. To this day I wonder if it is still in some

archive in some part of MI whatever.

I left Washington in 1980 to go to New York, out of that

world of electronic intel but kept in touch with Eric. I visited his farm and

met his two sons and of course his wonderful wife. But unlike the depiction in

book, the farm was a version of "Faulty Towers" with animals! We saw

an old farm, with rather weathered barn, and rabbits, chickens, sheep and a

mass of other animals just wandering around. You see, a farm is not something

one retires to, it is something one retires from! As Keynes had noted in his

famous test, “A man, who does well in life, may have the good fortune to retire

and write books and do experimental agriculture” Keynes meant “gardening” not

the establishment of a full agricultural complex! But Eric and his wife were happy,

ecstatic to be exact, and their sons seemed to be prospering. We had our

scotches reminisced about the old days, I was now in the movie business, and

departed, regrettably not to meet again.

Thus the Eric I knew was a quiet but resourceful man, a gentleman

in the best use of the term, one who knew how to approach and solve any

problem, and one who was loyal to the best of extremes, and happy with his

animals! I was honored to have spent a brief time with him and his help allowed

me and others to move forward on our careers while remembering a good friend.

A couple of decades later I had started a telecom and fiber

business in Central and Eastern Europe, with offices in Moscow, Prague and

Warsaw. I chatted with my Moscow and Czech colleagues, all former technical

people in the old adversary, and recounted my friend and colleague Eric. The US

“customer” may not have heard of Eric but they clearly knew and respected him.

The mere fact that I was associated with him gave me credibility well above

anything else that I may have personally achieved.

Thus I was delighted to see and read this work about a dear

old friend. It presents his life during his youth and during the War. Eric took

technology to war on a personal basis. The book presents this exceptionally

well and uses Eric as an example of some of the best of the best. Eric would

take the work in Jonses’ lab and test it out in true combat conditions. These

tales are told again and again. In addition the book examines the post war

Intel in the case of the Soviets.

Overall the book is good. It does suffer from several

weaknesses which I shall relate here.

1. It really should have an editor to smooth out the flow of

information. For the text tends to vacillate between historical reports and personal

details.

2. The books by R. V. Jones displayed an ability to present

the technology in a somewhat readable form. This seems in my opinion to be

lacking in this book. The many systems that Eric worked on should be described

so that the average reader could understand the issues at hand.

3. Eric’s personality did not come through as well as it

should have. Then again since I spent three years with Eric toward the end of

his life I have a view which may not be that of those who had known him earlier.

In my above recollections I tried to demonstrate Eric as creative, supportive

and especially loyal. Eric was one of those few friends who would go to then

ends of the earth to help you.

I considered Eric a good friend and in many ways a superb

teacher. Decades later when I returned to MIT I tried to explain to today’s

students how "real engineers" function, and I used Eric as a prime

example. In many ways we should really miss the Erics of the past. Today we

have an overabundance of Internet “techys” whose egos and overblown self-worth

belie the real engineering expertise of those who established the platforms

upon which they build.

Labels:

Commentary

Friday, November 24, 2017

How Not to Do R&D

I am always amazed when political figures opine on R&D. One can suspect that they can say whatever they want since their peers are equally clueless. Now a piece in Project Syndicate, that left wing blog for internationalists states:

A paradigmatic

example is the American Telephone and Telegraph Company (AT&T) and

its Bell Labs, a story meticulously recounted by Jon Gertner in his 2012

book The Idea Factory.

The research, discoveries, and products that emerged from this single

entity are astounding: not only reliable relays and switches for

landline telephony, but also radar, lasers, the transistor, the

integrated circuit, the fax machine, satellite communications, Shannon’s information theory,

the theory of computation, six sigma quality control, and even cosmic

microwave background radiation. All of this happened inside a corporate

behemoth, which could afford the lab thanks to its monopoly on local

telephony and on the equipment used to provide the service, which was

manufactured by AT&T’s subsidiary, Western Electric.AT&T’s monopoly

position was always controversial in the competition-minded US

regulatory system. So the company had to earn the right to be a

monopolist by constantly improving its service and using its research

power for national purposes such as military defense. To renew its

corporate charter in 1956, it even had to agree to license all of its

old patents royalty-free and to license all new patents at low cost. If

AT&T had to be a monopoly, it had to be a monopoly that benefited

society at large, not just its shareholders, through breakthrough

research. ...As societies consider their R&D strategies, they must find ways to

coax their largest corporations into a more AT&T-like bargain. If

citizens are to tolerate or even support these companies’ power,

companies must use it in ways that bring outsize benefits to the rest of

society. Their R&D budgets, their patent history, and their

innovations are part of what they should brag about in public.

I reviewed the book by Gertner and in that review detailed his many fallacies. AT&T ran Bell Labs to maximize the profits of the Bell System, NOT to advance technology. Remember that AT&T had profit based on a percent return on invested capital. Its operating costs were guaranteed in its rate base. Thus to maximize profit you built the most inefficient and capital intensive system possible! I know because I was there. As to Corporate R&D, the author should look. Corporations all too often "buy" new ideas, ideas generated in the cauldron of a free and open R&D environment. Look at the pharma business. Yes they do some R&D but they also but successful start ups. Look at immunotherapy and CAR-T cells as an example.

It is not surprising that a Harvard Prof would opine in this manner. One must have done something real to understand how the system functions. In my opinion, reading third hand material, and fallacious analyses, does not get you there. Socializing companies is not the answer.

Labels:

Technology

Subscribe to:

Comments (Atom)