Let us examine the data.

Industrial Production appears on average, weak but on par. This frankly is the best metric.

Income is below the lowest. Income is just not recovering and in fact it will be the driver for the next dip. Despite Production, if there are no customers then we will see that drop also.

Employment is very weak. Not the worst yet but getting there. It shows no sign of any improvement and this will drag on well into 2014.

Retail Sales seems to be keeping up but I suspect that a good deal of that is credit increase as well as Government Supports; Unemployment, FICA elimination and Food Stamps. These Government Programs are non job creating and just add drag to the economy.

The GDP stats show we are now below the lowest. This is truly a concern. The weak growth rate will not see any improvement under the current administration.

Personal Consumption, an element of the GDP, is well below the lowest. People are just not buying, not enough income and employment.

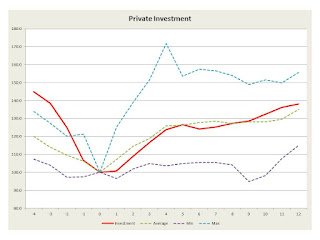

However Private Investment is above average. Money is around but the investments do not result in employment, just improvements in productivity.

Government Consumption is the lowest yet, and much of this is State and Local.

Exports are high relative...

Imports are average.

The above presents a dire forecast for 2013-2014, especially if we remain on course.