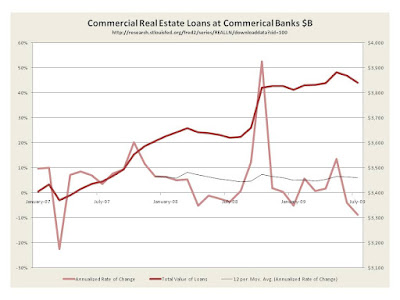

The growth in commercial loans remains flat to negative. As we had written nine months ago, the two remaining things to drop were commercial real estate and related loans and high yield debt financing which will come due momentarily. The commercial loans are reflective of the slow growth in the commercial sector and the continuing downward pressure on real estate there as well. Thus we are still quite concerned that problems here will keep the economy down. Banks have not changed their reserves since we last reported there as well.