Here is the latest.

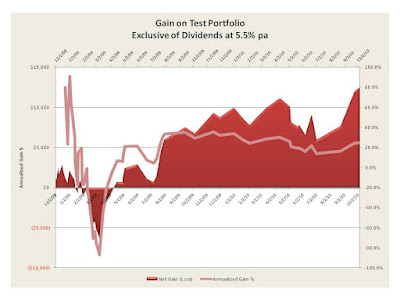

The gain on the original $25,000 portfolio is now $16,000 plus a 5.5% annual dividend yield. This comes out to a 22% annual yield. Note that we saw the initial dip and then the return with the annualized return remaining at the high 20% level.

We depict the same above showing growing gain and a stable rate of return on this core portfolio.

The following is a daily rate of return plot.

The Market seems quite strong and perhaps we will not have a classic October surprise. Yet there is the question of where is the demand coming from? The elements of the portfolio are shown below with their total gain over the period. All but Verizon have done well.

| Verizon Communications Inc. | 5.53% |

| International Business Machines Corp. | 77.40% |

| The Dow Chemical Company | 57.03% |

| Johnson & Johnson | 12.69% |

| Kraft Foods Inc. | 22.17% |

| E.I. du Pont de Nemours & Company | 103.15% |

| Alcoa Inc. | 28.33% |