The Homeobox and its related genes have played an

interesting but challenging role in developmental biology and now in cancer

pathways. The genes related to this 180 base pair section of DNA are the genes

which control the development or organs and the time at which these development

occur. Furthermore the structure of this gene collection is preserved across an

dramatically large number of species, the human included. Thus it was

interesting to see a paper in NEJM discussing the mutation of a specific Homeobox

gene, HOX B 13, as relates to prostate cancer.

The novel HOXB13

G84E variant is associated

with a significantly increased risk of hereditary prostate cancer. Although the

variant accounts for a small fraction of all prostate cancers, this finding has

implications for prostate-cancer risk assessment and may provide new

mechanistic insights into this common cancer.

Now this appears as a significant new finding and we would

like to examine this a bit. The HOX genes are quite unique in their

functioning. They are built about a core Homeobox segment, which is preserved

across chromosomes and species, and is hen connected with variable regions on

differing chromosomes to generate some 4X13 possible genes (HOX (A,B,C,D) (1…13)).

These genes are core to the morphological and embryological development of a

broad range of species.

Now HOX B 13 is one of many Homeobox based genes. These

genes are distributed across 4 chromosomes and have a fixed part called the

homeobox part and a variable part. In a sense it is similar to the fixed and variable regions we see in the immune system. The gene is created as below:

Homeobox genes are clustered in the

chromosomes and are expressed in the body in the same order in which they occur

in the chromosomal DNA. The HOX genes, the concatenation of the respective Homeobox and its

variable part are named by chromosome location as A,

B, C, D, and then by number 1 through 13 at present. The number reflects what

makes the Homeobox genes of interest, namely the genes

control the development of the embryos, namely they control what cells do as a

part of the development of an entity. The process goes from head to tail, and

the numbering goes from the earliest or anterior to the latest or posterior

elements in the development process. Thus HOX A 1

relates to an early development and HOX B 13

would refer to a later development of the embryo. The sequencing is shown below.

Retinoic acid activates the Homeobox genes sequentially in

development.

Now the Ewing study examined patients with specific changes:

Given the consistent

evidence of prostate-cancer linkage to 17q21-22 markers in our multiplex families

with hereditary prostate cancer, we designed a targeted sequencing strategy to

analyze 2009 exons of 202 genes contained in the most likely genomic interval

defined by our fine-mapping studies. … Probands from four families were

observed to have the same nonsynonymous mutation in HOXB13,

a change of adenosine for

guanine (transition, c.251G→A) in the second position of codon 84

(GGA→GAA),

resulting in a nonconservative substitution of glutamic acid for glycine (G84E)

The question is perhaps where does the term Homeobox come

from. From Gehring and Hiromi we have the definition:

The term

"homeosis" (originally spelled "homoeosis") was proposed by

Bateson (8) to describe the transformation of one structure of the body into

the homologous structure of another body segment. Homeotic transformation can result,

for example, from abnormal regeneration of amputated structures (epigenetically)

or from germ-line mutations

Thus the Homeobox genes are key to the development of

embryos. They also lead to the discussions

Scott states:

Homeotic genes control

cell fates during the development of all animals, as was first revealed by studies

of the Drosophila homeotic gene complexes … Many of these genes contain a homeobox, a 180 bp sequence

of DNA which encodes an evolutionarily conserved DNA binding

domain, the homeodomain … A plethora of mammalian homeobox genes have been reported, among

which 38 are located in four clusters. A new nomenclature for the mammalian Hox

genes, approved … The new names take advantage of the elegant arrangement

of the genes to provide a logical nomenclature system

rather than the names given when the genes were discovered. The new system is initially

designed only for vertebrate genes, although it is to be hoped that

similar systems will be useful, and adopted, for other animals. In order to preserve

as much

clarity

in the literature as possible, it has been agreed by a large number of workers in the

field and by the nomenclature committees that homeobox genes not located

within the Hox complexes should not be given names containing the word 'Hox'.

There are four

clusters of Hox genes … now to be known as A, B, C, and D. Based on sequence similarity the

genes can

be sorted into 13 'paralog' groups, each group having, in

most cases,

a representative

in each complex. The order of paralogs along

the chromosome is preserved in the four complexes. The genes

within a

complex

are

transcribed in the same direction and are numbered according to their

paralog

group from 1 at the 3' end to 13 at the 5' end. In several

cases

a representative

of a paralog group is absent from a complex, in which case the corresponding gene number is

omitted …

HOX genes are key to the development of the embryo, it

creates the head to tail and sets up the control of the development of the

organs. As Lohmann and McGinnis report:

Hox genes

play a major role in the morphological diversification of the anteroposterior

body axis of animal embryos by switching the fates of segments between

alternative developmental pathways . In their role of controlling segment

diversity, Hox proteins are responsible for many different morphological structures

and cell types within a given segment. But it is still largely a mystery how a

single Hox gene

can determine a morphological trait at a specific location within a segment,

and why that trait does not appear elsewhere in the same segment or in other

segments.

… morphological and

transcriptional responses to Hox genes

can be highly local, sometimes only in a single cell, allowing

one Hox gene to control a

cavalcade of different traits within one segment and between different

segments, depending on the information present. Another important lesson that

we can learn from the papers of Rozowski and Akam and Brodu et al. is that, during development, Hox genes act at all levels in the

developmental hierarchy.

If they act very far down in the hierarchy, as in

these two cases, then the output is subtle, with Hox genes acting as cell-type switches rather than as major

developmental pathway switches. If they are acting (apparently) far up in the

hierarchy, then the fate switch is more dramatic, which is most beautifully

demonstrated in the famous four-winged fly. But even at this general level,

context is still crucial: loss of Ubx in

the haltere does not generate a leg, but a wing.

There are many debates still raging regarding Homeobox and

Robert presents an interesting report summarizing some of them. His paper is

worth the reading. It builds on the evo-devo issue, evolution and development,

the ontogeny recapitulates ontogeny. Namely if the same HOX genes are present across

many species, and preserved in structure, then is there really an underlying

commonality across species.

We provide the details on the various HOX genes below. They

all have the form as we had shown earlier and they are all numbered in a

sequence consistent with what we have shown earlier.

We now show from Kim et al the development of the pathway

for the HOX B 13 that we have been discussing. It inhibits CDK and that in turn

inhibits the activation via E2F of the cell cycle. It is the inhibition of the

cell cycle that is of the most concern.

As Kim et al demonstrate the HOX

B 13 blocks p21 and in turn CDK2 keeping the RB pathway from entering the cell

into cell cycle reproduction. They state:

Taken together, the

results of this study demonstrated the presence of a novel pathway that helps understand

androgen-independent survival of prostate cancer cells. These findings suggest

that upregulation of HOXB13 is associated with an additive growth advantage of

prostate cancer cells in the absence of or low androgen concentrations, by the

regulation of p21-mediated E2F signaling.

Now Ewing at al conclude as follows:

In summary, we have

used linkage analysis in combination with targeted massively parallel

sequencing to identify a recurrent mutation in HOXB13

that is associated with

early-onset and hereditary prostate cancer. From a clinical perspective, testing

for germline mutations in BRCA1/2 is recommended in some families, since mutations

in these breast-cancer–susceptibility genes are associated

with elevations in the risk of prostate cancer, particularly for BRCA2 However, neither of these genes has been

shown to contribute to hereditary prostate cancer. HOXB13

G84E is associated with a

significantly increased risk of hereditary prostate cancer.

This work suggests

that future DNA sequencing studies using next-generation technology and study populations

enriched for genetic influence (as evidenced by an early age at onset and

positive family history) may identify additional rare variants that will

contribute to familial clustering of prostate cancer. Although HOXB13

mutations will be identified

in a minority of men with prostate cancer, rare genetic lesions can identify

pathways that are found to be abnormal in more common, sporadic cases.

This leaves one to somewhat guess as to how prevalent this

mutation is. The rough numbers given in the Weing paper is about 1.5%. It also begs the question of why as a mutation which is apparently

inherited the progression of the cancer is so slow. Ewing at al show that the

odds ration can be as high as 32.5:1 when the mutation is present. The age at

diagnosis is lower with an odds ratio of 2:1 but with the problem one sees in

pathway control one wonders why the cancer does not appear much earlier as seen

in BRCA.

Thus this paper raises several questions:

1. The Homeobox mutation is a predisposing genetic risk factor.

If tested and found positive for the factor what should be done next.

Mastectomy is often what BRCA patients undergo, does this mean prophylactic

prostatectomy?

2. The pathway seems to be somewhat understood. The E2F

family control the pathway and HOX B 13 controls that pathway. It blocks it to

some degree. What can happen to HOX B 13 to cause this change in non-mutated

individuals.

3. Can the disease propensity be regulated by genetic

pathway control, is this possible as an alternative prophylactic measure.

4. What other pathway elements should be considered. Specifically, if we have a mutation on HOX B 13 then must we have other genes also altered to up surge cell replication. If so which ones. Is HOX B 13 merely a predisposing element. Also is there a HOX B 13 type change in other PCa?

5. Most importantly, why does it take so long for the cancer

to develop, are there precursor hits somewhere and this this just eliminates

other hits?

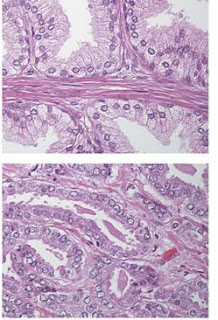

Ewing et al have an interesting slide showing normal versus

HOX B 13 prostate cells and we replicate it below from the paper.

In

the top slide we see well-structured prostate cells with basal and luminal

layers not showing and aberrant growth, no PIN. In the slide below from a HOX B

13 patient with a mutation of the form: GGA to GAA Glycine Glutamic acid (See

Ewing et al).

References:

-

Ewing, C., et al, Germline Mutations in HOX B 13

and Prostate Cancer Risk, NEJM, Jan 2012 V 366 N 2 pp 141-149.

- Jung, C., et al, HOX B 13 Homeodomain Protein

Suppresses the Growth of Prostate Cancer, Can Res 2004 V 64 pp 3046-3051.

- Kim Y, et al, HOX B 13 promotes Androgen

Independent Growth, Molecular Cancer, 2010 Vol 9-124.

-

Lohman, I., W. McGinnis, HOX Genes, Current

Biology, 2002, V 12 pp 514-516.

-

Robert, J., Interpreting the Homeobox; Metaphors

of Gene Action and Activation in Development and Evolution, Evo & Dev, 2001

V 3:4 pp 287-295.

-

Schwartz, J., Homeobox Genes, Fossils, and the

Origin of the Species, Anat Rec 1999 V 257 pp 15-31.

-

Scott, M., A Rational Nomenclature for

Vertebrate Homeobox, Nu Acid Res 1993 V 21 No 8 pp 1687-1688.

- Gehring, W., Y. Hiromi, Homeotic Genes and the Homeobox, Ann Rev Gen 1986 V 20 pp 147-173.