First is Industrial Production. The problem here is that it is falling again, and frankly this is a serious concern since it appears to be a trend.

Below we depict Income. This is the most worrisome. We see Income at the lowest in any recession, it is jut not recovering.

The one below is Employment. As with Income it is low and close to the lowest in terms of recovery. This clearly is an employment driven downturn. I suspect as do many that we are seeing a structural shift. Manufacturing is not just going off-shore but is computerized and thus any such jobs just no longer exist. What is required is not allowed under union controlled immigration. We allow low skilled workers but prohibit high skilled technical people thus creating a future competitive country to arise.

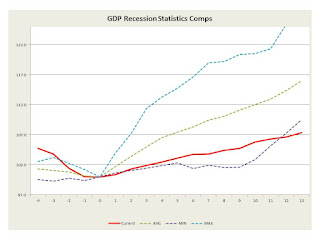

Strangely Retail Sales have been recovering but this along with the employment data is actually concerning. People with lower paying jobs seem to be spending more.The GDP comps are shown below. Again we seem to be falling off the cliff in terms of any recovery. In fact we are quite close to a second recession and given what DC is doing I suspect we shall see just that in Q1 2013.

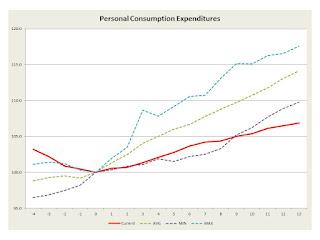

Personal Income is falling consistent with previous discussions. This is a true concern.

Private Investment is on the norm but again this is a driver for increased productivity and lower work for pay and participation.

Government Consumption is lower than other recoveries which is a surprise given the various stimulus programs.

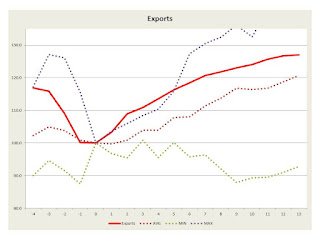

Now for Imports we have the chart below. As we shall see with exports, they are stable.

Exports are on par.

In summary we are looking at a weak at best recovery and more than likely a new recession. Four years have not done a great deal, if any deal at all.