GDP

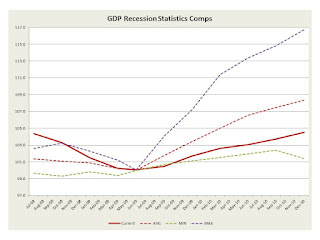

First the GDP and its components. The GDP itself is as below:

The above is the GDP scaled to the minimum point of the Recessions as recorded by the St Louis FED. The Recessions used by the St Louis FED are:

| Peak | Trough |

| November 1948 | October 1949 |

| July 1953 | May 1954 |

| August 1957 | April 1958 |

| April 1960 | February 1961 |

| December 1969 | November 1970 |

| November 1973 | March 1975 |

| January 1980 | July 1980 |

| July 1981 | November 1982 |

| July 1990 | March 1991 |

| March 2001 | November 2001 |

| December 2007 | June 2009 |

The GDP in periods before and after the nadir are shown as follows, in Quarters:

Note that we are near the bottom of upturns. One can make all sorts of arguments but the facts seem to still indicate that it has been the cumbersomeness of the current Administration that caused this.

Personal consumption as above now seems to becoming healthy. It was exceptionally weak after the drop and has lagged.

Private investment had been running along at an average rate but the drop in last quarter is a concern to GDP growth going forward.

Government consumption had been average but with the change in Congress we anticipate a drop here. Frankly that is a good sign since it was exploding and taking money from private interests.

Exports are above average and below we show the same for imports.

The above are the GDP and its elements. There are no truly exceptional signs here so we do not anticipate a rapid move from the Recession.

Other Data

Now we have a few other stats. First is Industrial Production which seems healthy:

Then we have personal income which is quite a serious problem. This will be the major factor. While Wall Street is walking away with billions funded by TARP we have Main Street doing worse than ever. Wall Street should really worry about this, but as usual they are ignorant of it in toto.

The above is the personal income data we spoke of. It is well below the worst recession data available!

Now we can look at employment data, and we see the weak recovery.

Finally retail sales has shown some signs of life as we see it climb to above average levels.

The real concern is the income number and this will most likely hold back the economy.