The use of the Baseline Portfolio we have been watching since December 1 2008 is shown above. We are seeing the downward slope of the bundle and the yield is slowly declining. The problem is that the market has been the only safe haven for much of the investment given the lower rates of the bond markets.

The above shows a better view perhaps of what we have been saying. We were on an upward trend but Japan has brought that to a halt.

The yield curves are shown above. The low curve was last year in August but we see a steepening now.

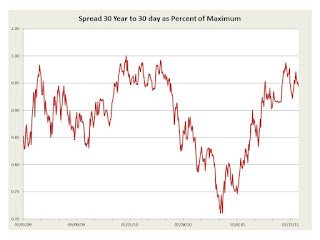

This shows the spread and we see that the spread is nearing the peak over the past two year period again. The question is will we see a higher spread. The FED has kept the lid on this but like nuclear reactors sooner than later the pressure will be just too much.

This demonstrates the 90 day and 10 year rates and spread. The spread here is back to peak and the 90 day yields are drawn back down again, but the 10 years are not that high.

Thus one must ask, where are the returns. For those on fixed incomes and those near retirement this poses a disaster situation. Place SSI pressure on this and we will see an explosive result in the next election when this becomes more apparent.

skip to main |

skip to sidebar

A blog containing opinion and analysis in a wide array of areas including the economy, health care, broadband and international relations.

About Me

- Florham Park, NJ, United States

- Terry has spent most of his career in industry, half in corporate executive positions, and half involved in his start ups. He started on the Faculty and Staff at MIT in 1967 and was there until 1975, and he had returned to MIT from 2005 to 2012 to assist groups of doctoral and post doc students. Terry has focused on a broad set of industries from cable, to satellite, wireless, and even health care software and medical imaging. Terry has published extensively in a broad set of areas as well as having written several books. Terry has returned to Medicine on Boards at Columbia University Medical Center. Copyright 2008-2024 Terrence P McGarty all rights reserved. NOTE: This blog contains personal opinions of the author and is not meant in any manner to provide professional advice, medical advice, legal advice, financial advice. Reliance on any of the opinions contained herein is done at the risk of the user. For publications see: https://www.researchgate.net/profile/Terrence_Mcgarty

Key Connections

Blog Archive

-

▼

2011

(391)

-

▼

March

(42)

- Boy, These Economists Really Get Mad!

- Operation Cupcake

- End of an Era

- China's View on the Libyan War

- The Budget Mess

- Pane et Circum

- The Information: Gleick

- 150 Years of the Equations by Maxwell

- Childhood Obesity, Type 2 Diabetes, and What to Say

- Khan Academy Great Idea

- Consolidation of Wireless

- One of the Dumbest Things I have Ever Read

- Economics and Science and Engineering

- Backscatter and Radiation Again

- A Book Review

- More on Cancer Stem Cells

- Happy Saint Patrick's Day

- Airport X-Rays and the Facts

- Market Snapshot

- An Interesting Economic Proposition

- Beware the Ides of March

- Broke or Not Broke? That is the Question.

- Internet Usage Charges

- Prostate Cancer and the Government

- Extreme Gardening: New Jersey

- Response to My Newspaper Post

- More on the Cancer Stem Cell

- Global Warming and Belief

- Newspapers in the Old Days

- Now They Blame Mother!

- Bikes, Bike Riders, and the Rest of Mankind

- Is It the Health Care or Just the People?

- Happy Women's Day

- Welcome Spring 2011

- Sir Egwyn Squirrel and the Grail

- Great Analysis of Health Care Counter Move

- Comments From the Unknown

- The Baloon Proposal

- Unemployment: Better or Worse

- An Interesting Proposal

- Over-Diagnosed; A Review

- Will The Government Replace Unions?

-

▼

March

(42)

Labels

- Academy (261)

- Advice (1)

- AI (33)

- Amazon (27)

- AMTRAK (1)

- Antitrust (5)

- Antnee (1)

- Artificial Intelligence (1)

- Baseline Portfolio (29)

- Bats (1)

- Bears (2)

- Bees (2)

- Biodiversity (2)

- Biofilms (1)

- Books (81)

- Botany (4)

- Bridges (1)

- Broadband (84)

- Business (5)

- Cancer (291)

- Cap and Trade (26)

- CAR-T Cells (5)

- CATV (34)

- Chemistry (1)

- China (81)

- Christmas (1)

- Church (12)

- Climate Issues (19)

- Commentary (796)

- Commentary. (3)

- Common Carriage (1)

- Communication (1)

- Companies (1)

- Computers (1)

- Congress (3)

- Constitution (4)

- COVID (23)

- CRISPR (31)

- Culture (1)

- Cyber Warfare (5)

- Daylilies (10)

- Dell (1)

- Dentists (3)

- Diabetes (13)

- Disinformation (1)

- DNA (1)

- Drugs (1)

- Economics (175)

- Economy (515)

- Education (50)

- Electronic Medical Records (14)

- Electronic Shopping (1)

- Employment (2)

- Energy (8)

- Environment (2)

- Epigenetics (4)

- EU (1)

- Europe (1)

- FAA (2)

- FCC (45)

- Finance (3)

- Fox (1)

- French (1)

- G20 (5)

- Gene Drive (1)

- Genetics (22)

- Ginkgo (1)

- Global Warming (43)

- Google (34)

- Government (192)

- Guest Blogger (1)

- Health Care (593)

- Healthcare (9)

- History (5)

- Hollywood (1)

- Immunization (1)

- Individualism (4)

- Information (3)

- Infrastructure (1)

- Innovation (3)

- Intellectual Property (1)

- Intellectuals (1)

- Internet (30)

- Internet Neutrality (13)

- ISPs (1)

- Japan (2)

- Language (1)

- Law (26)

- Libraries (4)

- Marx (4)

- Mathematics (1)

- Media (13)

- Medicare (2)

- Medicare for All (1)

- Medicine (11)

- Microsoft (42)

- Middle East (3)

- Military (10)

- Millennial (2)

- MIT (30)

- Models (1)

- MOOCs (13)

- Multimedia Communications (3)

- NASA (23)

- Nationalism (1)

- Natural Rights (4)

- Navy (1)

- New York City (2)

- News (2)

- NJTransit (3)

- Nuclear Weapons (15)

- Obesity (14)

- Observation (1)

- Paine (1)

- Pandemic (515)

- Pandemics (4)

- Papacy (7)

- Patents (1)

- Peer Review (2)

- Personal (1)

- Political Analysis (47)

- Political Correctness (3)

- Politics (165)

- Power (1)

- Press (8)

- Privacy (5)

- Quality (1)

- Rare Earths (4)

- Recession Statistics (3)

- Regulation (2)

- Religion (7)

- Revolution (2)

- Rome (1)

- Russia (46)

- Science (13)

- Security (5)

- Shakespeare (1)

- Social Media (2)

- Socialism (4)

- Software (2)

- Space (2)

- Squirrels (15)

- Strategy (1)

- Taxation (4)

- Technology (15)

- Teeth (1)

- Telecom (38)

- Terchnology (1)

- Test (2)

- Testing (1)

- The English (2)

- Turkeys (4)

- Twitter (1)

- UK (3)

- UPS (2)

- USPS (8)

- Utilities (1)

- Vaccine (4)

- Vaccines (4)

- Vatican (3)

- Verizon (11)

- Virus (20)

- Voting (11)

- War (5)

- Warfare (1)

- Weather (1)

- Wireless (8)

- Yield Curve (14)

Publications

Important Documents

Total Pageviews

Telmarc White Papers

Cookies EU

Notice: This site is written by me and operated by or under the aegis of Google via Blogspot and May Contain Cookies. This notice should suffice as a warning which may be required by EU regulations. Then again, it is the EU after-all and this may not reflect the regulated reality but at least you have been advised. Copyright 2008-2026 Terrence P McGarty All Rights Reserved, also quotes are from referenced materials and are used under a Fair Use principle as they are commented upon and linked back to.

NOTICE

All documents and materials on this web site are the copyrighted property of Terrence P McGarty, the "Author", and can be used solely for individual purposes. The Author also does not represent in any manner or fashion that the documents and information contained herein can be used other than for expressing the opinions of the Author. Any use made and actions resulting directly or otherwise from any of the documents, information, strategies, or data or otherwise is the sole responsibility of the user and The Author expressly takes no liability for any direct or indirect losses resulting from the use or reliance upon any of the Author's opinions as herein expressed. There is no representation by The Author, express or otherwise, that the materials contained herein are investment advice, business advice, legal advice, medical advice or in any way should be relied upon by anyone for any purpose. The Author does not provide any financial, investment, medical, legal or similar advice on this website or in its publications or related sites. Also the author may, from time to time, include items from other publications on the reliance of "Fair Use" principles in Copyright Law and such items are used in the opinions stated, they are also referred to by source and delineated as coming from such third party sources. This Blog is not implemented in any manner to generate revenue or any other benefits and is solely for opinion and expression thereof. Any who have concerns about referred to comments should contact the Author for prompt remediation.